Wondering How To Amend Your Tax Return?

Everybody makes mistakes. But it’s easy to panic when the mistake you made was on your tax return. Fortunately, the IRS isn’t anywhere near as scary as people make them out to be. Yes, they will come after you if they suspect you’ve committed tax fraud. Other than that, however, they’re actually pretty easy to get along with. If you make a mistake on your taxes, fixing it is actually a very simple process.

Table of Contents

Everybody makes mistakes. But it’s easy to panic when the mistake you made was on your tax return. Fortunately, the IRS isn’t anywhere near as scary as people make them out to be. Yes, they will come after you if they suspect you’ve committed tax fraud. Other than that, however, they’re actually pretty easy to get along with. If you make a mistake on your taxes, fixing it is actually a very simple process.

What is a Tax Amendment?

“Amend” is just a fancy way to say fix, and that’s e exactly what you do when you amend your return. Filing an ended return tells the IRS that you made a mistake on your taxes and gives you an opportunity to explain and correct it.

Taxpayers make innocent mistakes on their taxes all the time, and the IRS is quite used to dealing with this issue. If you realize you made a mistake, you simply follow the IRS process for amending your return and move on. The odds are high that you’ll file an amended return and never hear anymore about it from the IRS — unless, of course, they owe you a larger tax refund.

How Far Back Can You Amend a Tax Return?

Under IRS rules, you generally have three years to file an amendment. This three-year window begins on the day you file your original return. If you file your 2020 taxes early on February 1, 2021, you can amend your return until February 1, 2024. If you wait until April 15, 2021, to file, you have until April 15, 2024, to amend.

There is always an exception when it comes to IRS rules, and tax amendments are no different. Sometimes taxpayers owe when they file their taxes and may not be able to pay the debt right away. If you owed taxes when you originally filed, you have two years from the date you paid your tax debt to amend the return.

How to File an Amended Return?

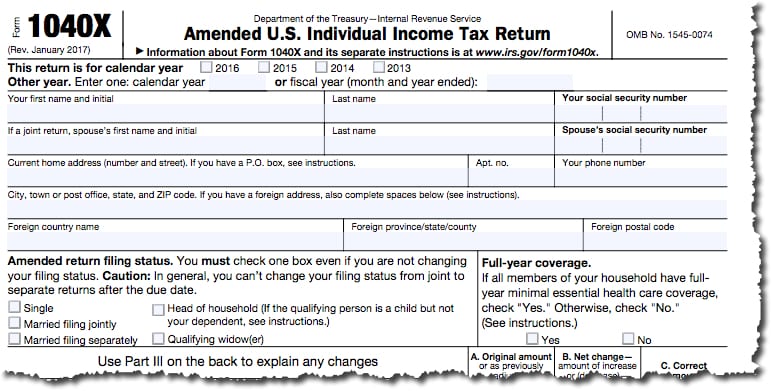

Amending your return requires one fairly simple form. You will need to file IRS Form 1040X in order to correct mistakes on your return. Don’t worry if you’ve never used this form and don’t know how to file 1040X. The process is actually super easy.

1040x Tax Amendment Form

The form begins by asking for your taxpayer identification information and what tax year you’re filing the amendment for. Under this basic information you’ll find three columns.

In the first one, report your tax information exactly as you did on your original return. In the third column, report the correct amounts. In the middle, write in the difference between the number in the first column and the number in the third. You are essentially preparing a side-by-side comparison of what your original return actually said and what it should have said.

On the second page of the form, you will see a space where you can change your dependent and exemption information if necessary. This is also where you will explain in writing the reason you’re changing your return.

For many years, the IRS only accepted amended tax returns by mail. In the summer of 2020, however, the IRS began accepting electronic 1040X submissions. If you used e-file to file your income tax return, you may be able to use the same tax preparation software to file your Form 1040X. Every software package is different, so you’ll need to check with yours to see if this service is available.

When to Amend a Tax Return?

You should amend a return as soon as you realize that you made an error. If you filed a paper return, your mistake could be something as simple as an arithmetic error or a transposed number. Even if you chose to e-file and the computer did the math for you, there are still times when amending a return is warranted.

Perhaps you forgot to report your income from a side gig you did at the beginning of the year. It’s also possible that you received a W-2 or another tax form late or that you’re employer sent you a corrected W-2 after you already filed your taxes. All of these situations warrant amending your return.

You must also file an amendment if you claimed yourself as a dependent on your taxes and then found out that your parents did too. In this case, you will have to decide who had the rightful claim. If you and your parent are both entitled to claim you as a dependent, give the exemption to whoever will benefit the most from it.

You can also change your return if you made an error that increased your tax liability. If you realize, for example, that you forgot to deduct your student loan payments or claim your healthcare deduction, you are allowed to amend your return to include these forgotten deductions and improve your tax picture.

Of course, the IRS also expects you to amend your return if you made a mistake that worked in your favor. If you owe the IRS more money after completing your amended return, you’re expected to remit your payment along with your amendment.

Tips and Examples

When filing your amendment, there are a few tips to keep in mind. Because we do so much paperwork electronically these days, it’s easy to forget the basics. It seems simple, but make sure you remember to sign and date your amended tax return if you’re mailing it in. If you’re sending in a paper form, you’ll also have to submit copies of supporting documents like corrected W-2’s. Remember to consult the Form1040X directions. The IRS requests that these documents get attached in a certain order.

Don’t get so caught up in the numbers that you forget to explain why you’re fixing your return. There is a place on the second page of the 1040X form to explain yourself and it’s important that you remember to do so. Your explanation doesn’t have to be long and involved. You can simply say “received a corrected W-2” or “forgot to report savings account interest.” Again, remember that the IRS deals with these issues all the time and you probably won’t take them by surprise.

If you have to file multiple amendments, understand that you’ll need to file each one separately. Let’s say, for example, that you started college in 2018 but didn’t realize you could deduct your tuition payments on your taxes. In this case, you’ll need to amend both your 2018 and 2019 returns using two different Forms 1040X. You’ll need to file an amendment for each year separately.

Is there a Risk of Audit?

The short answer is yes. The IRS uses a computer to randomly choose returns for audit, so there is always a risk that you’ll be one of the lucky ones whose return gets selected. The act of amending your return, however, does not necessarily increase your audit risk. Remember that people make mistakes on their taxes every day, and dealing with amendments is a common occurrence at the IRS.

As a general rule, however, the IRS has three years to audit your taxes if they so choose. This timeline is extended, however, if you understated your income or your basis in a sold property by 25 percent or more. In that case, the IRS has six years in which to complete an audit. Still, so long as your mistake was an honest one and you have the documents you need to back up your amendment, an audit should be relatively quick and painless.

Need help from a Professional?

If you’ve made a mistake on your taxes and aren’t sure how to fix the problem, remember that we’re here to help you with whatever you need. Getting help from the IRS directly is often an arduous process involving lots of time spent on hold and customer service representatives who mean well but aren’t always super helpful. It’s best to have a professional helping out through this process. You can contact a member of Picnic Tax’s online CPA network and get the help you need to confidently and correctly amend your taxes if necessary.